Private Equity: KKR Raises USD 19 Billion for Middle Market Investments

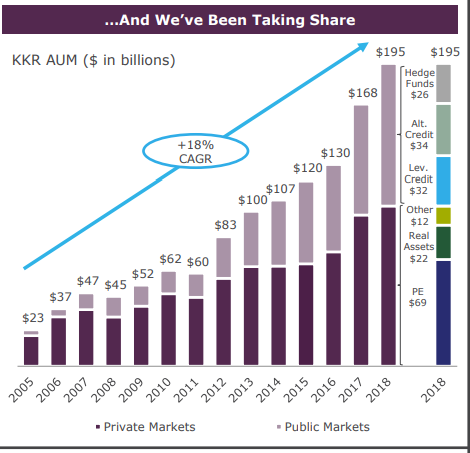

Expanding Access to Private Market Investments

Middle Market Focus: Kohlberg Kravis Roberts Co. (KKR), a leading global investment firm, has launched its latest private equity fund, the Altegris KKR Private Equity Master Fund, with a focus on established but smaller companies with enterprise values of USD 250,000 or more.

Minimum Investment Requirements

Recognizing the need for increased accessibility to private market investments, KKR has lowered the minimum investment threshold for its new fund to USD 10,000. This allows a wider range of investors to participate in this traditionally exclusive asset class.

Accessing Private Equity through a Single Investment

The Altegris KKR Private Equity Master Fund offers a unique investment vehicle that provides immediate exposure to a diversified portfolio of private equity investments without the need for ongoing capital calls.

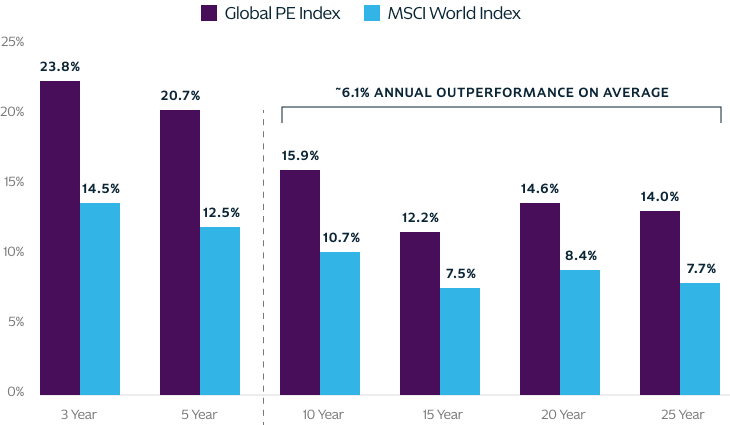

Building on a Strong Track Record

KKR has a long-standing reputation for delivering superior returns in private equity. The firm's previous private equity funds have generated attractive returns for investors.

Expanding Investment Opportunities

Private market investments have traditionally been accessible only to high-net-worth individuals and institutional investors. KKR's new fund democratizes access to this asset class, allowing more investors to benefit from its potential returns.

Komentar